November 2024 Update

Apologies - slightly late this month, due to weekends away making the most of the amazing winter weather in sunnier climes than the UK. Just to set the scene, I’m writing this while sat outside a cafe drinking cappuccino in shorts and t-shirt while people whizz past on electric scooters, bikes and walking their dogs. News from home tells me the weather is somewhat different, with snow and storms in the past month.

In case you’re not a market geek, markets have been on a rip recently. Said market geeks are starting to use words like ‘overheated’ and ’expensive’. I’m holding more cash than I’d like again, because I occasionally get caught in a ’try and buy on a dip’ trap, no matter how small. It’s a logical fallacy I know (anchoring), but that doesn’t stop me trying and feeling like a hero if I successfully catch a couple of percent drop.

Before getting to the numbers, here are some ramblings.

Things I’ve Been Thinking About

Chinese cars, specifically EVs. I live in a country where Chinese cars are more available than the US or Europe. It’s becoming clear that although China has had mixed success with internal combustion engines, they don’t struggle with EVs. It seems that no matter what the experts in the Daily Mail or YouTube comments or government policies may say, pure economic forces dictate the inevitable move to EVs (simplicity, reliability and cost of ownership). It’s also clear that China can build cars of a quality and cost that consumers find highly acceptable (and western brands can’t). A recent visit to a showroom selling a variety of brands including Range Rovers, Jaguars, BMW’s, Audis and Jetour, had most people crowding around the Jetours. This isn’t just a curiosity thing either as they’re a very regular sight on the roads. It’s a fun game trying to guess whether the car you see a few hundred metres away is a Jetour T2 or a Land Rover Discovery. Then there’s the Xioami GU7 that Ford CEO Jim Farley declared he didn’t want to give back after 6 months of driving it. Most western car makers, driven by short term market forces and being experts in building hugely complicated internal combustion engines, have flip-flopped on strategy and struggled to have the belief and go through the pain required to transition to build cars that are an operating system attached to a battery and motor. It’s not controversial to suggest that at least one of them is going to go bankrupt. The cracks are beginning to show, with CEO resignations, redundancies and factory closures. A transition to a higher market share of Chinese imports seems highly likely.

Degrees and the minimum wage. In the UK, the minimum wage is about to increase to more or less the amount at which graduates are required to start paying back their student loans. This makes it official - there is now a graduate tax. University should be a very carefully considered choice, not the default. It seems to me that the whole further education system is dysfunctional. A significant proportion of degrees are pointless, even the worthwhile ones take too long (<2 days a week of study) all propped up by government lending (who’d have thought it). If people were individually responsible for borrowing money for education, would it look the same? I think not. What to do instead? I was watching a YouTube video of a couple building an extension this week. A bricklayer quoted £2900 for 3 people for a weeks work. I’m guessing that two may have been earning more than the third, so pessimistically, a skilled bricklayer is earning £1000 a week e.g. £52k. Remember also that this can’t be compared to a PAYE employee, as being self employed, less tax will be paid. Lets guess and say it’s maybe equivalent to £55-60k. A friends brother was anecdotally earning closer to £80k as a builder. Another YouTuber in Oxford had been quoted £1500 for 2 men for 1 days work to repair some gutters. £270k a year and again, self employed! Or if you think being out in the weather isn’t for you, how about being a train driver? Average salary £48k.

Interesting Watching

If you’ve spent too long watching TikTok, why don’t you try lengthening your attention span and increase relaxation levels by watching Martijn Doolaard. He breaks all the YouTube rules by making videos that are typically 50 minutes or longer where things happen very slowly. It’s way better than I make it sound. His channel shows his journey as he purchases some land with a couple of animal shelters in the Italian mountains and converts them into liveable huts, growing his own food and keeping chickens. His videos are well shot, cinematic, atmospheric and totally absorbing.

Net Worth Comments

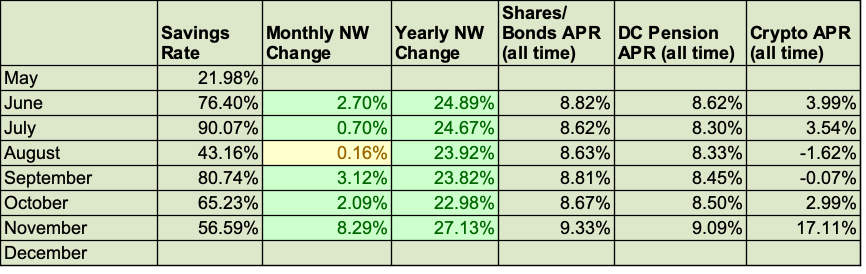

A ‘good’ month with entire net worth increasing by 8%. I’m reminding myself that this run can’t last forever and ‘bad’ months will provide more future opportunity. Savings rate is slightly depressed this month due to a weekend away and other discretionary spending. It’s still healthy in absolute terms, so I’m training myself to spend more. A habit of disciplined saving and investing is hard to break even though it’s less and less necessary considering the position I find myself in. Although I still have financial goals (which I’m going to update due to hedonic adaptation!), the need to scrimp and save seems less important.

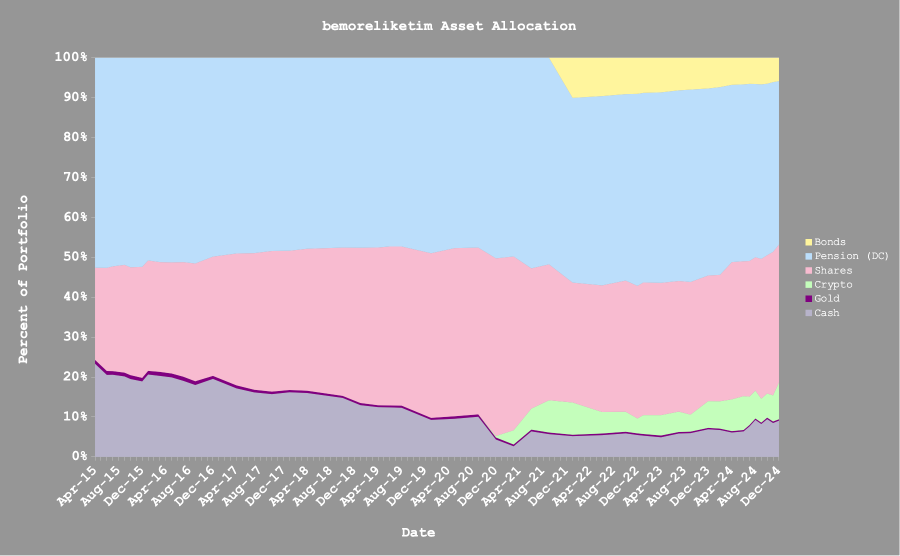

VWRL is £112 up from £106 last month. Bitcoin is also up significantly which despite being a modest fraction of my portfolio has provided significant effects. Here are the numbers and graphs.