My Investment Portfolio

What investments do I hold? What changes would I make?

If you’ve read My Financial Blueprint, you’ll have a few clues as to what my investment portfolio might look like. I always find it interesting when people tell you the details of what they do rather than using vague statements about holding ‘most’ of their investments in index funds or owning a ‘small number’ of individual shares for fun or owning a ‘conservative’ amount of Bitcoin. Without specifics this can be frustrating. It’s a bit like Marco Pierre White telling you to roast a chicken by putting it in the oven for a while, or Matt Bellamy showing you how to play a C chord. Without the exact details of the process, techniques and timings it just leaves you wanting more.

With the caveat that I’m not a financial advisor, my situation is unique and likely nothing like your situation and that none of this constitutes financial advice, let’s get started.

Pension (Defined Benefit / Final Salary)

I was lucky enough to pay into a final salary pension for 12 years. I’ve valued this by comparing it to the cost of buying an inflation linked annuity that would match the income as detailed on the last statement received.

Pension (Defined Contribution)

This is my current workplace pension. Altogether 31% of my salary is contributed with 10% being the company contribution. The fund used is the default fund, a global tracker with 10% bond allocation. Ordinarily the standard profile would have me slowly transitioning to a ‘safer’ product by now, but I’ve stopped this as I’d rather take the risk with fewer bonds considering I have a DB scheme.

Overall, returns have averaged 7%.

Stocks & Shares ISA

I’m contributing more to my ISA than my DC pension in an attempt to get to a more equal balance.

I’m also planning on reducing the holdings to just VWRL and the bonds, however I’ve been hesitating for two reasons. Firstly the other funds have a slightly cheaper expense ratio (not a great reason because it’s a minor difference) and second, because with the additional choice, I can take advantage by buying dips in a more specific sector (not a great reason because I should know you can’t predict the market). Is that me just identifying my irrationality? I should really simplify into VWRL . . let’s see if I do.

Overall, returns have averaged 9.5%.

Shares

- VANGUARD FUNDS PLC FTSE ALL-WORLD UCITS ETF GB (VWRL) (70%)

- VANGUARD FTSE UK ALL SHARE INDEX A Acc (17%)

- VANGUARD FTSE EM MKTS ETF (8%)

Bonds

- ROYAL LONDON AM SHORT DURATION GLOBAL IDX L (RLAAAM) (2%)

- VANGUARD UK GOVERNMENT BOND INDEX Acc (3%)

Cash

This is a combination of a cash ISA, current accounts and a couple of regular saver accounts that have better interest rates than current accounts. I cycle money through these to increase my return. This also includes my matched betting funds scattered throughout various bookmakers accounts and exchanges.

Peer To Peer

I was an early adopter of peer-peer, opening an account with Zopa (one of the first UK providers) shortly after they first opened. I now also have accounts with Ratesetter and Funding Circle. They all work in different ways and service different customer bases. This will soon reduce as Ratesetter has sold its loan book to a bank. Despite the wailings from various corners about how risky it is, returns have been solid across all providers since 2005 and in the range of 4-6% (depending on provider).

Cryptocurrencies

This is a new venture for me. I’ve spent the last six months thinking about getting involved and wish I’d taken action sooner. It goes without saying, this is a volatile space and not for the those who can’t stomach ~80% dips. I’m strictly limiting investment to an amount I can afford to lose and while principally holding Bitcoin, have invested across a couple of other coins for some diversification. This is a long term position. I’m also, possibly controversially, not planning on rebalancing. Being an engineer I’m fascinated by the concept and possibilities in this space and also enjoy the excitement and controversy that surrounds it. It’s a risk, but sometimes it’s fun to take a risk right?

Stocks & Shares (non ISA)

These are shares held as a result of participation in company share purchase schemes. These will be sold shortly and transferred into my S&S ISA.

Gold

I own some physical gold, after a friend offered it to me many years ago. If a zombie apocalypse occurs, maybe I’ll be able to trade gold filings for food!

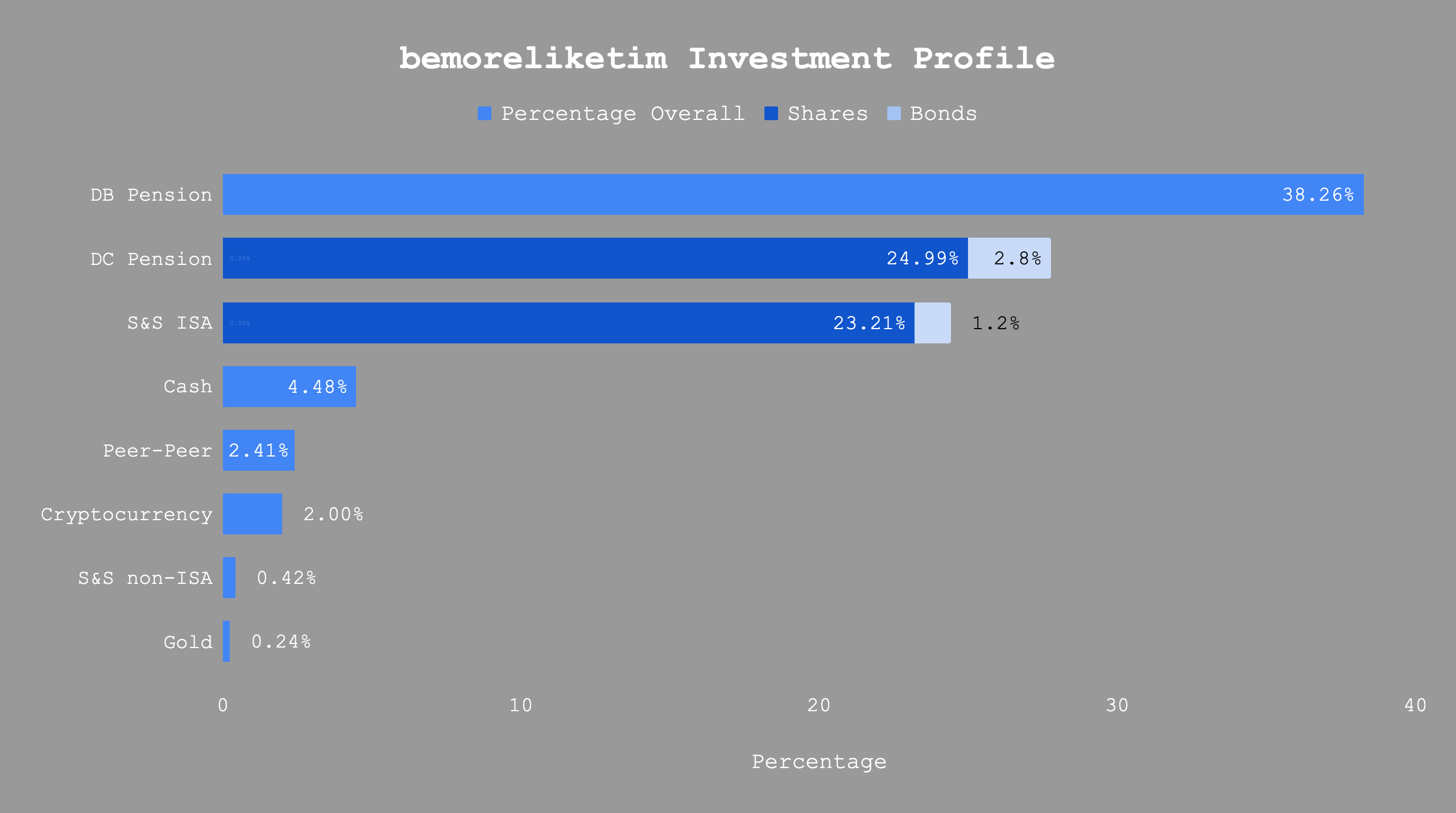

Summary - Chart Time

Here is a handy chart showing the information graphically. I’ve broken the DC Pension and S&S ISA into shares and bonds.

Changes?

Despite keeping reasonable records in a spreadsheet, I’ve never looked at the data in this way before so it’s caused me to consider a few things. Firstly, how much my DB pension is worth has surprised me. I didn’t realise how poor rates on annuities currently are, which has had the effect of making this worth more than I thought.

I’ve realised how pointless holding such a small amount of shares outside of an ISA is, so they will be sold and put into my ISA. This will have the added benefit of one less account. Simplifying financial bureaucracy is always a good thing.

I’m also considering a slightly higher level of peer-peer holdings.