May 2025 Update

Current Thoughts

I’ve spent late May/early June on holiday back in the UK hence the slight lateness in posting. The abundance of green was the first thing that struck me on arrival. Desert can be beautiful, but the contrast of so much lush vegetation everywhere was refreshing to see. Strange to also think that there’s talk of drought, meanwhile in the desert where rain was last seen in spring 2024 there’s no shortage of water. Oh the UK . . . !

Vital ViewingReading

Hat-tip to https://monevator.com/ for putting me onto this, but working in a similar industry, I found this fascinating. The comments about the inefficiency and fitness for purpose of the incumbent defence contractors struck a chord as did the problems associated with scaling a small, nimble, organisation while trying to avoid slowly morphing into a carbon copy of the very companies you’re competing against. https://joincolossus.com/article/the-amusement-park-for-engineers/

Last month I mentioned the All-In Podcast. Just a quick note to point out a high level of hypocrisy on show right now. Having spent the last few years telling anyone who will listen that they aren’t censored, aren’t scared of having difficult conversations and are all in favour of free speech, it seems once the shit hits the fan, some selectivity about how free their speech is and limits to how difficult a conversation they’re actually willing to have might indeed exist. The trouble seemed to arise when their favourite two men-child friends, the orange one and the DOGE master fell out and started calling each other names and hurling insults the like of which I haven’t heard since maybe primary school. Instead of release an episode to discuss, vested interests took precedence and the silence was deafening. The next episode (according to the comments) didn’t discuss the situation. Pathetic and disappointing.

Net Worth Comments

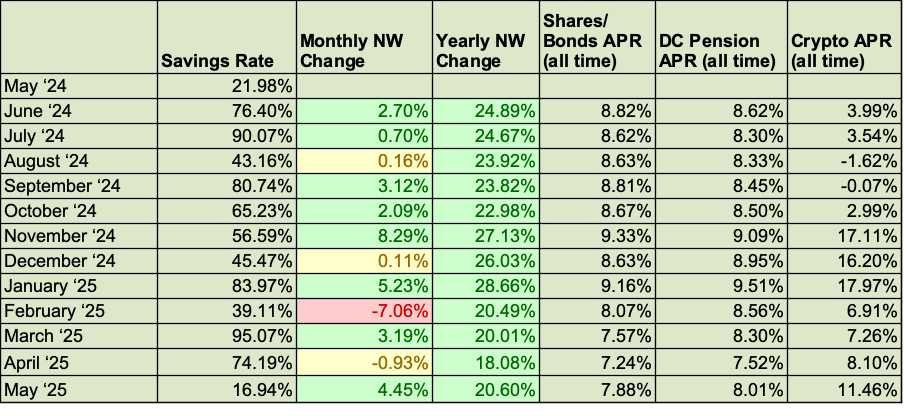

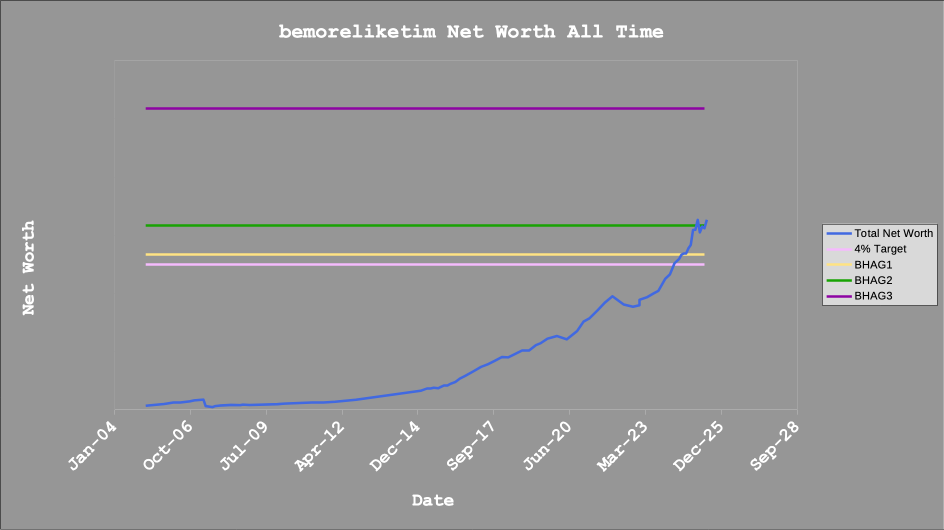

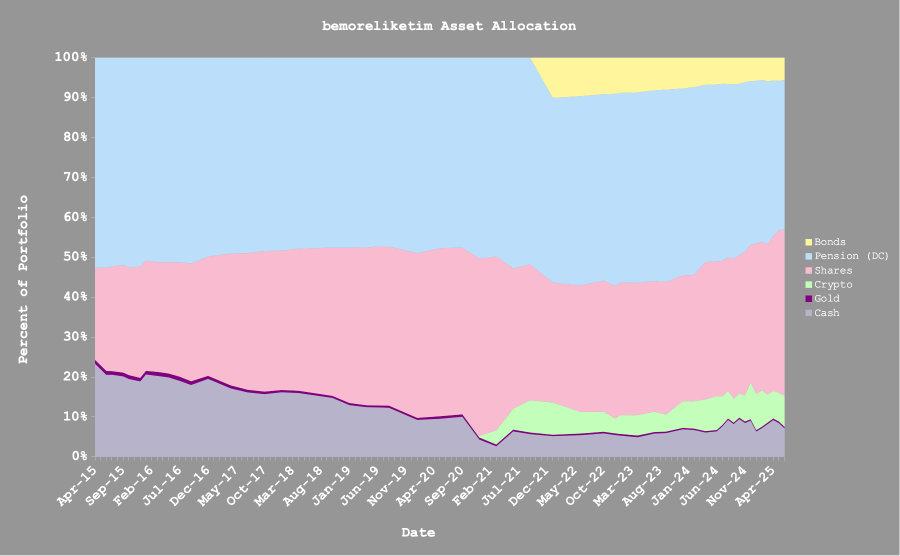

A new all-time high, albeit by a sliver. Markets have largely recovered from the orange man-child’s shenanigans and equities seem to be shrugging off the high level of country level debt (bond yields are starting to reflect this). I have relatively low exposure to bonds as a deliberate decision due to having a final salary pension scheme (albeit not being a current member for a long time). VRWL is not quite back up to where it was in February. Bitcoin has been having a good run as has gold as markets seem to like the look of anything that isn’t related to a government. As the owner of a few ‘altcoins’, Bitcoin dominance has been growing, so my overall crypto portfolio, although doing well, has had it’s performance tempered by this - the price of diversification.

Savings rate dropped to an all-time low as a result of buying quite a few flights and the rent payment being due. Recovery due in June . . although a further holiday booked. YOLO.