May 2024 Update

So here I am, metaphorical pen in hand, thinking I should write a post, but not having anything specific in mind. Consequently, I’ll ramble on about my current thoughts on various things and also give you a free new chart I’ve been working on.

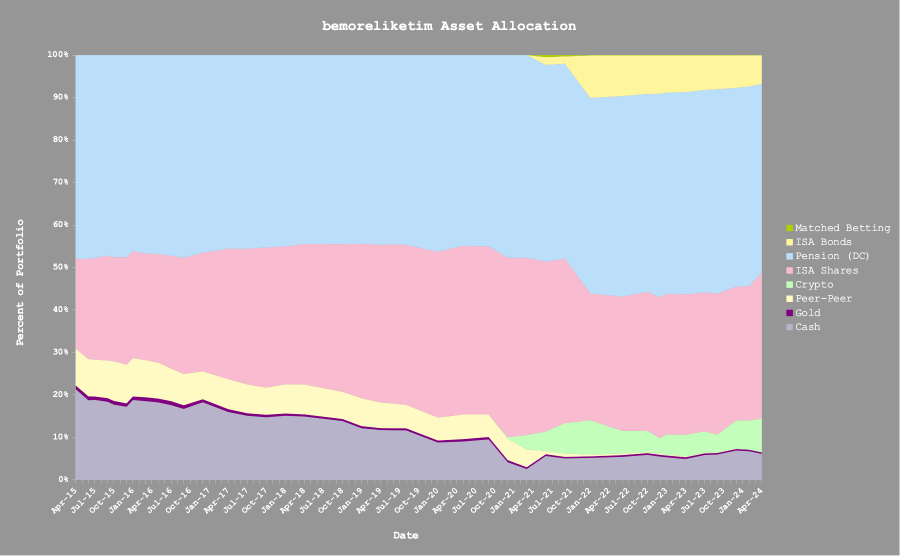

Chart of the Month

While updating spreadsheets, I made a new chart. I found it handy to see a graphical view of asset allocation as a percentage over time. My takeaway from the below chart was that I could probably do with more gold.

Talking of Gold . .

. . everyone is talking about gold. China is buying. It’s overvalued etc etc . . feel free to DYOR. It’s at all time highs and obviously there are an infinite number of commentators views on where it’ll go from here. I watched a recent interview on YouTube with a market pundit, where he revealed he has a 40% allocation! As usual I’ll follow the well established rules; no-one knows, so stick to sensible allocations. <1% looks a bit low to me, so I’ll buy some more. My last purchase was somewhere around 2013 and as near as makes no difference, it’s doubled in value, so I haven’t done too badly.

Watches

I work with a few watch fans and have consequently visited a couple of watch stores recently. Initially I just didn’t get it. I wear a £20 Casio calculator watch and it’s never let me down. However, I’m beginning to understand the draw. They are part works of art, part mechanical engineering masterpieces and I appreciate the aesthetics. As an investment, they’re generally not good. I suspect they’re not really correlated to stocks but unlike other personal items (e.g. cars), they do hold some value if you buy well. In the unlikely event of capital gains, my understanding is they’re not taxed in the UK. This means if you’re going to enjoy the owning of a watch, there are definitely worse things to spend your money on. Will I indulge? Maybe. Or maybe I’ll just window shop instead.

A New Broker

I find myself in the position of needing a non-ISA stocks/shares broker. I already use two to spread provider risk, so a third will help both with my non-ISA requirement and spread provider risk further. After doing some research, I’ve opted for Interactive Brokers. They’re a bit like the opposite of Robin Hood - definitely no confetti when you carry out a transaction. I’ve certainly never had to answer so many questions to open an account. Their user interfaces aren’t very intuitive and it all feels like it’s evolved over many years with functions added rather than being removed. However, they are very well established, being founded in 1978, have a global presence and have a competitive pricing. They also have my preferred global tracker ETF, which is all that really matters.

The Markets

Lots of chatter about interest rates is the general summary. The markets expected some cuts, but the grown-ups are holding out. Who is right? As usual (see comments on gold above), no-one knows. This hasn’t stopped the YouTube commentators from calling Papa Powell names and questioning his suitability for the job (true story). Anyone with a mortgage is trying to hold their frustrations together, but most simultaneously realising they can’t complain too loudly, as they fully understood the seriousness of signing up for a 25 (to 35) year commitment while opting to borrow the maximum the bank would lend them. They also took the mortgage stress test very seriously and appreciated the repercussions of interest rates rising. They definitely didn’t go out and purchase the car they’d recently sold in order to reduce their expenses to pass the stress test (another true story). All the wise owls crowing about how good an investment a house is have retreated to their respective boxes. I haven’t read any recent articles on whether it’s best to pay off the mortgage or invest in stocks either. Cycles repeat, but our memories seem to fail.

Crypto

Currently looking strong but the media have mostly forgotten about it because interest rates are more interesting and provide greater cannon fodder due to more normies getting rekt.

Net Worth

As high as it’s ever been. My April update showed me crossing a psychologically important arbitrary round number that was very exciting (for about an hour).

EV Values

I’ve seen a few articles in the media pointing out in horrified tones, how much second hand EVs have fallen in value. These are the same media outlets that only a few months ago were pointing out in horrified tones how expensive second hand EVs were. There’s no pleasing some people. Takeaway: buying a second hand EV now seems like a sensible move. I recently drove a Polestar from London to Devon and it’s one of the most impressive cars I’ve ever driven. I think I probably used the brake about 5 times during the whole journey and only had to move the steering wheel to overtake slower cars as the lane keep skills were so capable. The throttle took care of itself on the motorway with adaptive cruise control. We stopped for a quick break around halfway for food/coffee/toilet and charging was seamless. The stop time was dictated by the food/coffee/toilet not the charging. Infrastructure is clearly improving and the cars are so much better than they were (looking at you my ex-Leaf!)