August 2025 Update

Monthly Thoughts

August has been mostly uneventful. An MTB holiday to the Alps in July, so a few weeks of less exciting behaviour was due. This has the added bonus of not being expensive.

I really enjoy downtime. Sitting on the sofa drinking tea, listening to music or watching videos. The world seems to think this is a waste of time, but I find it regenerative. It allows my mind to wander. Think about the future, the past, failings, successes, where am I, what am I doing, what is my plan. This also allows me to start the week feeling rejuvenated and mentally fresh. I find it also means I sleep better at the weekends because I know I don’t have to get up and do anything. Pure relaxation. In sympathy with that train of thought: https://www.afterbabel.com/p/on-the-death-of-daydreaming

Vital Viewing

Having been a regular cyclist for most of my life, this video gave me optimism on the future of cycling in the UK. London is clearly starting to get it. Kerb separated cycle lanes are the future and if you build it, they’ll come. Hopefully the rest of the UK will start to follow along and remove the absolute waste of space that a lot of cycle lanes are. Benefits to this becoming more normal: less traffic (less noise, less pollution, less stress), happier humans, fitter humans, less ill humans (less strain on the NHS), wealthier humans. There are literally no downsides. https://www.youtube.com/watch?v=53OAx5hKxbQ

House of the Month

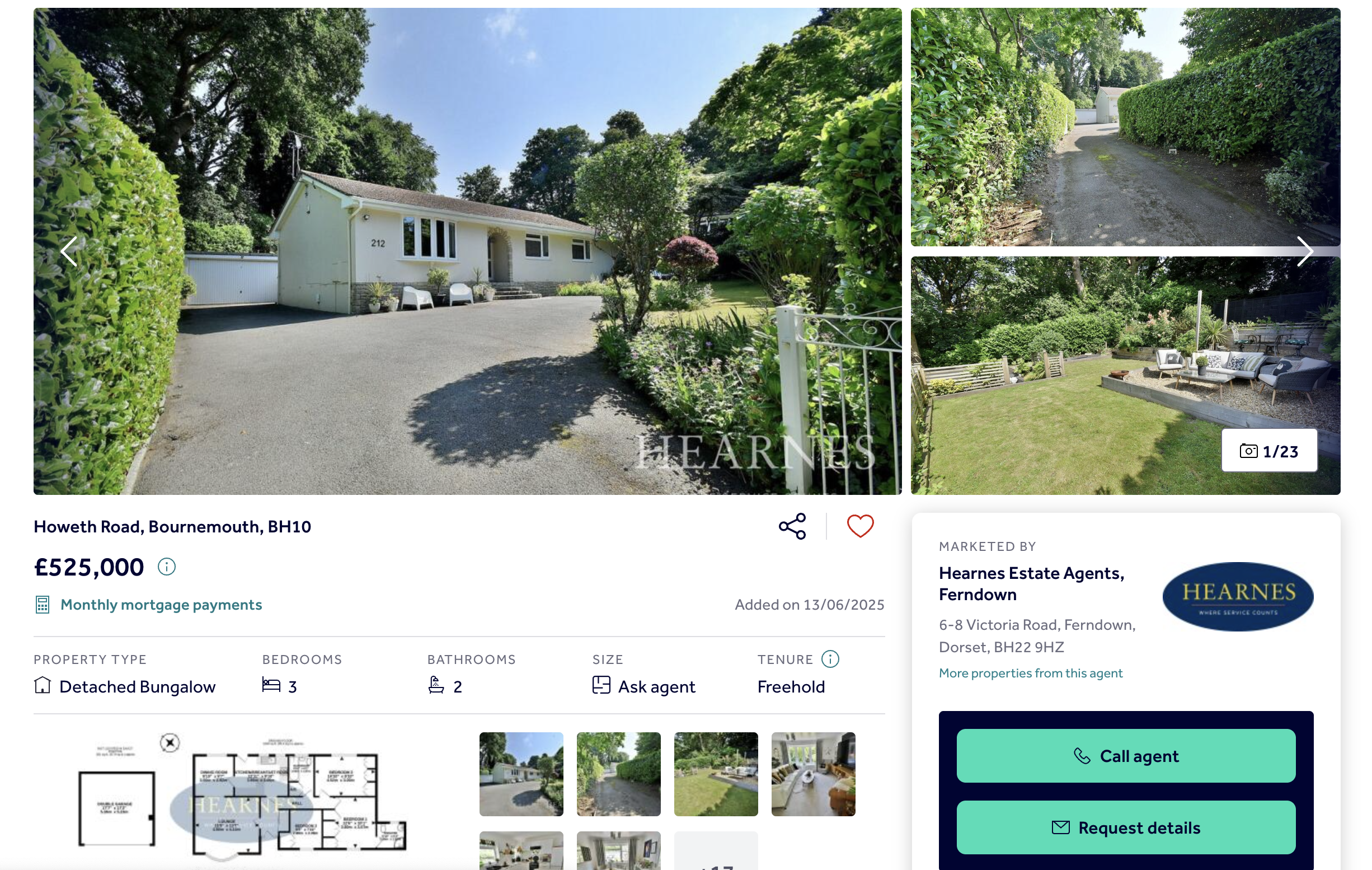

Like a lot of people, I like the odd bit of house window shopping using Rightmove. This month, I stumbled across this beaut in Dorset that won my House of the Month contest.

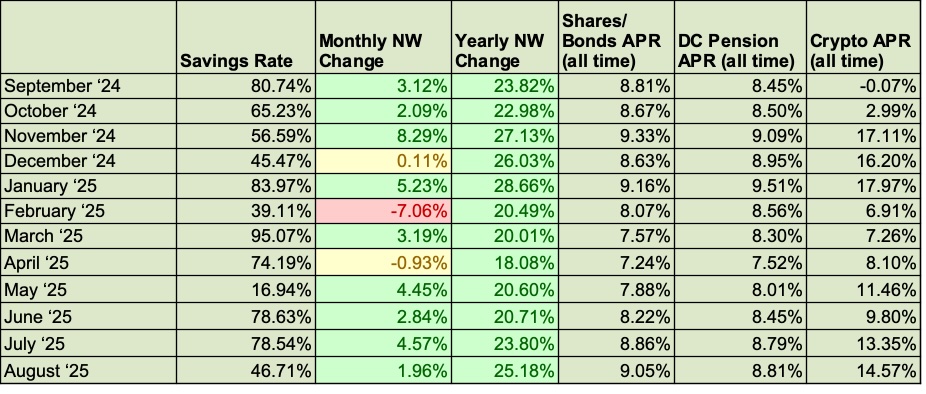

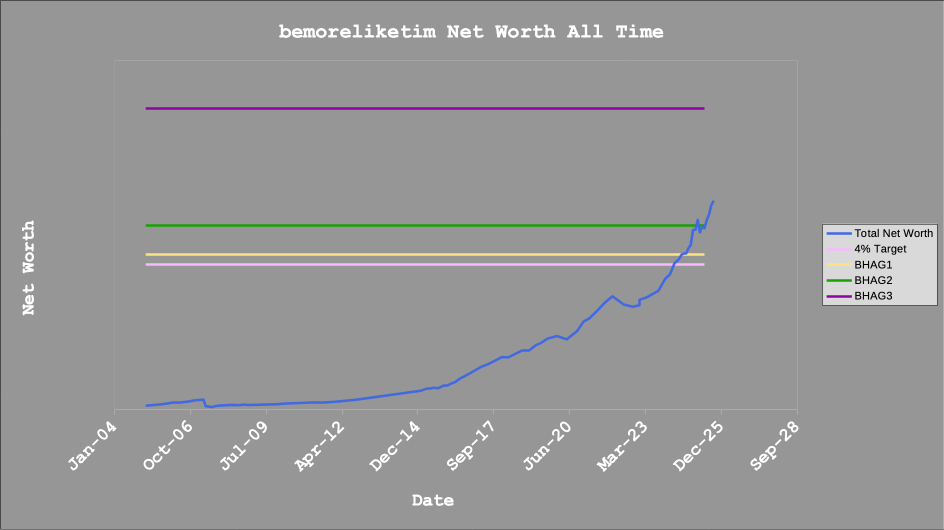

Net Worth Comments

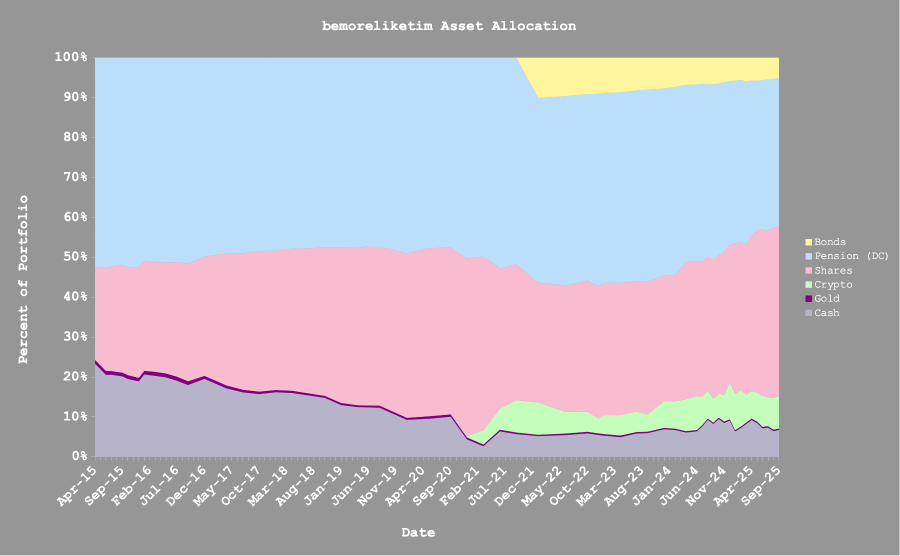

Stock markets are still on the rise as is crypto and gold and really everything apart from currencies. I’ve decided that next month, I’ll be purchasing some gold via SGLD. I’ve dilly-dallied for too long. The 0.12% charge seems very reasonable and it’s a physical gold backed ETF, so hopefully no funny business. The thought process here is as simple as rebalancing. I can try and justify this move to myself by saying holding Gold even though it’ll be a small percentage, will help reduce the pain of any stock market drawdown reduction when it occurs, but the truth is as always, no-one knows what’s going to happen, but being somewhat diversified is normally advantageous. Don’t overthink it.